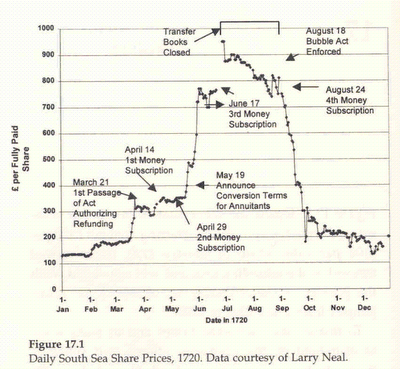

The South Sea Company successfully triggered

a speculative mania for its shares in 1720, with stock prices burst from £128 on January, £330 on March, £550 on May and gone up to the highest (forward) stock price £1050, recorded on 25 June. The

south sea company share has increased at least 700% during the short period. The

south sea company was able to support unusually high valuations as a result of

a £70 million fund of credit that was granted by Parliament for the purpose of

commercial expansion (more information, here).

|

| South Sea Company shares fluctuation in 1720 |

没有评论:

发表评论